I haven’t seen an actual paper credit card statement for a long time because I’ve banked electronically for years, but I switched banks recently and they just sent me my first credit card statement on this new account.

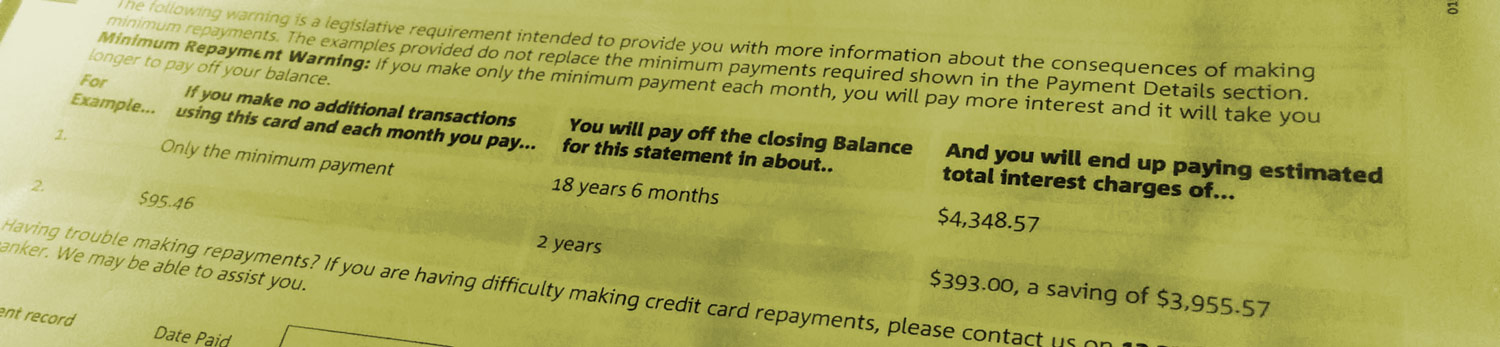

I was really pleased to see a prominent section on the statement (mandated by government legislation) pointing out just how long this bill will take to pay off if I were only to pay the minimum amount. I think this is a great thing for developing financial literacy, as I’m always shocked at just how little some people know about money, especially credit, and how little they understand its impact.

On my credit card’s closing balance of $1898.20, it tells me that even if I spent nothing more on the card, and just paid the minimum required amount each month until it was paid off, it would take me 18 YEARS 6 MONTHS, and would accrue $4,348.57 in interest!

I hope we are teaching this stuff to kids at school, so they don’t fall into the “free money” thinking that so many adults I know still have.

My grandmother used to say “if you can’t afford to pay cash, you can’t afford it.” I think the more modern equivalent is “if you can’t afford to pay your credit card bill in full each month, you can’t afford it”

And yes, I always pay my credit card bill in full each month!

![]() Paid in Full by Chris Betcher is licensed under a Creative Commons Attribution 4.0 International License.

Paid in Full by Chris Betcher is licensed under a Creative Commons Attribution 4.0 International License.